$51 Million

Verdict for Price Manipulation

$9,600,000

Settlement on Obstetrical Malpractice Concerning a Monochorionic Pregnancy

$4,850,000

Settlement for Obstetrical Malpractice Resulting in Injuries During Birth

$4.4 Million

$4.4 Million Settlement for Delay In Diagnosis of Cancer

$19,200,000

Awarded to Widow of New Jersey Transit Worker Who Died of Job-Related Lung Disease

$10,215,715

Million Total Recovery in Cerebral Palsy, Hypoxic Ischemic Encephalopathy Birth Injury Case.

$7,000,000

Settlement in Medical Malpractice Case Involving Fatal Brain Injury.

$6,500,000

Recovery in Wrongful Death Intubation of Patient With Pneumonia, Sepsis & ARDS

$18.5 Million

Jury Verdict for Paraplegia Caused By Chemotherapy Error

$10,600,000

Awarded to Woman Injured in Ford Explorer Rollover

$9.6 Million

Settlement for Birth Injury/Cerebral Palsy

$5.2 Million

Jury Verdict for Urological Malpractice

$51 Million

Verdict for Price Manipulation

$9,600,000

Settlement on Obstetrical Malpractice Concerning a Monochorionic Pregnancy

$4,850,000

Settlement for Obstetrical Malpractice Resulting in Injuries During Birth

$4.4 Million

$4.4 Million Settlement for Delay In Diagnosis of Cancer

$19,200,000

Awarded to Widow of New Jersey Transit Worker Who Died of Job-Related Lung Disease

$10,215,715

Million Total Recovery in Cerebral Palsy, Hypoxic Ischemic Encephalopathy Birth Injury Case.

$7,000,000

Settlement in Medical Malpractice Case Involving Fatal Brain Injury.

$6,500,000

Recovery in Wrongful Death Intubation of Patient With Pneumonia, Sepsis & ARDS

$18.5 Million

Jury Verdict for Paraplegia Caused By Chemotherapy Error

$10,600,000

Awarded to Woman Injured in Ford Explorer Rollover

$9.6 Million

Settlement for Birth Injury/Cerebral Palsy

$5.2 Million

Jury Verdict for Urological Malpractice

Tractor-Trailer & Car Accidents

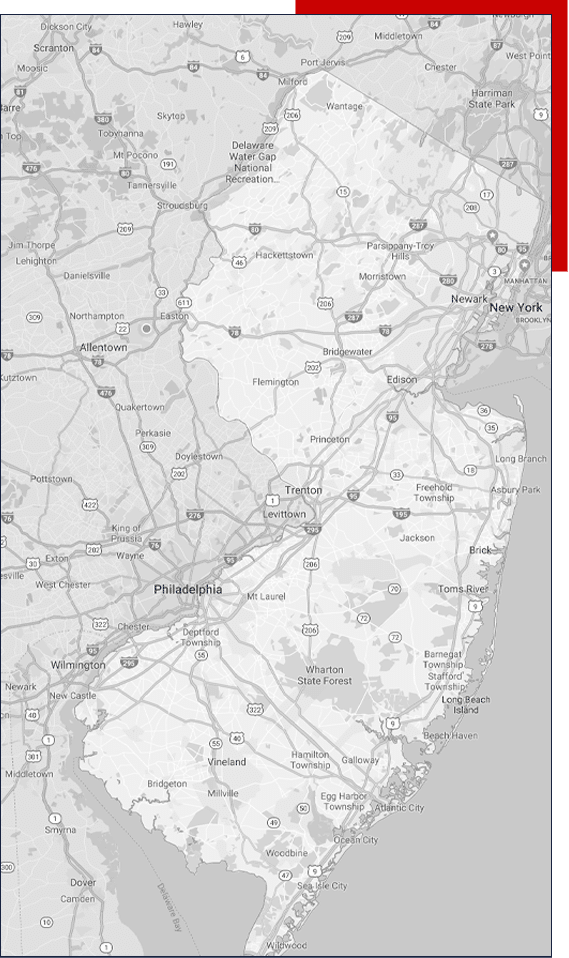

Aggressive representation for car crash victims throughout the state

Tractor-Trailer & Car

Medical Malpractice & Birth Injuries

Aggressive representation for Medical Malpractice throughout the state

Construction

Accidents

Aggressive representation for construction accident victims throughout the state

Product

Liability

Aggressive representation for product liability victims throughout the state

Experienced New Jersey Personal Injury

and Medical Malpractice Lawyers

Fighting for the rights of the injured throughout the state

Economists and financial experts have said that most people are one serious injury away from losing everything. Even if you have a nest egg set up for rainy days, a truly catastrophic injury – the broken back, the birth of a child with birth defects, the deadly product causing, the third-degree burns, the cancer misdiagnosis – can take away everything you worked so hard to earn. When your family’s future is on the line, you deserve a legal team who knows how to fight back on your behalf.

Eichen Crutchlow Zaslow, LLP is that team. Our NJ injury and medical malpractice attorneys have secured hundreds of millions of dollars on behalf of our clients. We’ve taken on high-profile cases that earned national attention and won. We have the skills, the experience and the resources necessary to see your case through to the end, and we don’t stop fighting until we know that you and your family have received full justice.

With offices in Edison and Toms River, we’re only a phone call away when you need us the most.

The Jersey firm you know and trust

Choosing an injury lawyer can be an overwhelming experience. There are a lot of firms out there; how do you know which one will actually fight for you?

At Eichen Crutchlow Zaslow, LLP, you get more than a team of experienced litigators: you get a team who knows your name, your experiences, and your goals, and who has your best interests in mind. We know that your injuries might preclude you from coming to our offices during normal working hours, so we make sure that we’re available to visit you or your loved one in the hospital or at the rehabilitation facility, and your lawyer will return any phone calls you make within 24 hours. Your case and your story are personal to us, whether you’ve suffered an injury that leaves you temporarily unable to work, or in need of permanent care for the rest of your life.

Our award-winning team of attorneys is accredited by the Better Business Bureau, and each of our partners is a Certified Civil Trial Attorney, a designation granted by the Supreme Court of New Jersey. We invite you to learn more about our firm, and our team.

Meet Our Attorneys

More About Us

Our Testimonials

Aggressive legal strategies for victims of tractor-trailer and vehicle accidents

Fighting for victims of tractor-trailer and vehicle accidents

There are about 39,000 miles of public roadways in NJ – and some days, it feels like you’re sharing every one of those miles with a tractor-trailer. Whether you’re on the Turnpike, 287, 18, 202, or Route 9: those trucks are everywhere, hauling goods up and down the coast. And with almost 6.5 million drivers in our state, it’s no surprise that there were 276,861 car accidents in 2019.

Eichen Crutchlow Zaslow, LLP has represented numerous NJ clients who have sustained severe, often life-threatening injuries, in collisions involving:

- Tractor-trailers

- Other cars

- Motorcycles

- Pedestrians and cyclists

- Uber and Lyft drivers

- Buses

- Trains

These types of cases can often lead to serious, life-altering injuries. Our firm proudly represented the family of James “Jimmy Mack” McNair, the only person who died in the Wal-Mart truck crash that injured Tracy Morgan, in a wrongful death suit. We know what you are up against when a trucking company puts it profits ahead of the safety of its drivers and of others sharing the roads.

Free Consultation

Millions of dollars recovered for NJ victims of medical malpractice and OB/GYN negligence

Morristown Medical Center. Hackensack Meridian. Robert Wood Johnson. Jersey Shore University Medical Center. AtlantiCare Regional Medical Center. According to U.S. News & World Report, these are the best hospitals you can find in New Jersey.

You know what else they have in common? We’ve won cases for patients at all of them.

We’re not saying we don’t have some very good facilities, but the truth is that even the very best doctors can still act negligently, and even hospitals with excellent reputations can drop the ball. We’ve represented clients who were hurt at NYU Langone, Sloan-Kettering, CHOP and New York Presbyterian, and at lesser-known but equally-reputable hospitals throughout the tri-state area.

An act of medical malpractice – where a doctor, nurse, surgeon, specialist, or administrator breaches his or her duty of care to a patient, leading to an injury that cause damages – can and does happen in hospitals all over this country every single day. When it happens to you, you deserve to have a team of medical negligence lawyers who know what it takes to win a case.

Eichen Crutchlow Zaslow, LLP has secured hundreds of millions of dollars on behalf of NJ medical malpractice victims. We have built a reputation for our work on behalf of cancer patients who have been misdiagnosed, or who have their diagnoses delayed, but we handle all manner of negligence cases, including:

We are also one of the few law firms in NJ which helps families pursue claims for wrongful birth and failures to diagnose genetic conditions. These are incredibly delicate, and incredibly tragic, cases. Like with all of the clients we help, we promise to treat you and your family with dignity, respect, and compassion for the position you are in.

Fighting for the rights of injured construction workers

According to the NJ Department of Labor, there were 155,000 construction workers (on average) in 2017, the number of jobs in the industry is increasing.

- Newark alone employed 34,910 construction workers in 2017.

- Middlesex, Monmouth and Ocean Counties combined represent the second-highest concentration of construction jobs – 28,210 – in the state.

- Bergen, Hudson and Passaic Counties had 24,120 construction employees.

- Most workers are classified as laborers, among the most dangerous jobs there are.

- 85% of the construction done was on residential buildings (28,501 total units).

With this many projects ongoing, and this many people working, the chances are good that someone is going to get hurt. While employees may be eligible for workers’ compensation, independent contractors and day laborers might not be – and there is where we come in. Eichen Crutchlow Zaslow, LLP represents employees, contractors, site visitors and others who have been seriously injured on or near construction sites, who must file a personal injury claim in order to seek compensation. Sometimes, these claims involve manufacturers of defective tools or devices; other times, they may be premises liability claims. Regardless of what kind of worksite injury claim you need to file, we can help. We also represent injured railroad workers who wish to file a claim under the Federal Employers’ Liability Act (FELA).

Handling complex product liability litigation

As a consumer, you should expect that the products you buy will work in the way they are intended to work. Everyone gets a “dud” now and then, as any “As Seen on TV” shopper can attest, but some product defects are incredibly dangerous, and they put you and your loved ones at-risk. Product liability litigation is a complex process, and it can involve multiple parties: the manufacturer, the product designer, the retailer, etc. Our firm has the resources to handle these claims, whether it’s an individual lawsuit against a local manufacturer, or against a global conglomerate. We routinely handle claims involving:

Our mass torts department is also equipped to handle claims involving consumer fraud, including internet privacy claims. If a dangerous product was allowed to go to market, or if consumers weren’t warned about the dangers associated with a particular product, the civil justice systems allows them to seek legal recourse. We’re the firm that can help you see those claims through to the end.

Serious help for NJ clients with serious injuries

Remember how we said that most people are only one serious injury away from losing everything? You might be surprised how those injuries can occur. Car and truck accidents cause the greatest numbers of deaths and injuries, but spinal cord damage, traumatic brain injuries, limb amputations and burn injuries can be the result of almost any act of negligence.

At its core, that is what a personal injury lawsuit is all about: holding a person or entity which acted negligently, and thus caused you harm and damages, accountable for that action. An unsafe sidewalk or a poorly lit parking lot at the local mall can lead to a fall, or to an act of violence. A neighbor’s dog which escapes from the back yard can bite a child. The nursing home that leaves your elderly loved one vulnerable to neglect or abuse can and should be accountable. The property owner who doesn’t keep his or her premises safe can and should be held liable. The government entity that takes your tax money but doesn’t protect you or your fellow citizens can and should be held responsible for those actions.

At the end of the day, when you have been hurt and you don’t know what to do or where to start, turn to us. The NJ injury lawyers of Eichen Crutchlow Zaslow, LLP have always fought on behalf of the “little guy,” and we’ve spent decades honing our craft so that our clients have the best possible chance at the outcome they want. We seek justice for our clients in settlement negotiations and in jury trials; in state courts and federal courts; in North, South and Central Jersey. When you need fighters, we’re ready to go.

Are you hurt? Let’s get started.

Eichen Crutchlow Zaslow, LLP is an award-winning personal injury and medical malpractice law firm serving clients throughout New Jersey. We offer free initial consultations at our offices in Edison and Toms River, and make in-home visits to clients who are too sick or injured to come to us. To learn more about our services or to schedule a consultation, please call 732-777-0100, or fill out our contact form. Let us get to work for you.